To start, we must define The heritage as a legal action, where the deceased person provides all their assets, rights and obligations or debts, which may be one or more people. Having the will made gives peace of mind to the family at the time of the inheritance, so it is important to be clear how to plan for retirement.

These people are known as heirs and they are natural or legal persons with rights to all or part of the inheritance. If it is about inheritances in Barcelona, you can look for a notary with experience, professionalism and reliability.

What is stipulated in the will can be a source of disagreements and fights between the heirs, but in the same way it can provide pleasant surprises and resolve unnecessary conflicts, so the wills of celebrities can bring a lot of queue.

Contents

Waiver of Inheritance

In the situation in which the heir to an inheritance does not want to keep the assets granted to him, it is a renunciation, which means that the heir repudiates the acceptance of the inheritance assigned by the deceased person.

To renounce an inheritance, the person from whom the inheritance is to be received must be deceased, as suggested by article 991 of the civil code:

"No one can accept or repudiate without being certain of the death of the person to whom it is necessary to inherit and of their right to inheritance."

Acceptance of an Inheritance

If instead of rejecting or repudiating the decision to receive an inheritance is made, it is very important to take into account various considerations.

The initial thing would be to accept it, having the certainty of the death of the person from whom we are going to inherit since it is very common to confuse the terms of acceptance and partition of the inheritance.

The acceptance is known as a voluntary and free act, in which the person in question shows his firm will to accept said inheritance.

What have been the most famous legacies?

There is a millionaire dog thanks to his master, the Maltese dog was the main heir to a heritage valued at 5 billion dollars.

Leona Helmsley, a New York real estate entrepreneur with a business valued at 5.000 million dollars, died in 2009, leaving behind her a relevant luxury hotel chain.

After the death of the millionaire, her beloved white Maltese named Trouble was transferred to the Helmsley Sandcastle hotel in Florida where he spent about 100.000 dollars a year for his grooming, food, security devices, etc.

Another case is that of the millionaire waitress, since a widower and childless, a wealthy American left a large tip.

At 82 years old and without a relative to whom to leave his money, Bill Cruxton wanted his inheritance of more than 500 thousand dollars to be destined for a special person.

Cara Wood was a 17-year-old waitress who kindly waited on Bill every day when he went to Dink's Restaurant and did not find out about this inheritance until after Cruxton died of a heart attack.

Finally, there is the 5 dollar inheritance for a daughter, since there was an American lawyer who was not very happy with the women in his family when he wrote his will.

Leaving only 5 dollars of inheritance to his daughter while his wife did not leave even a penny.

The rest of his 100 thousand dollars, an important sum if we consider the decade in which this event takes place, were destined to a trust that would last 75 years to later create the Zink Without Women Library.

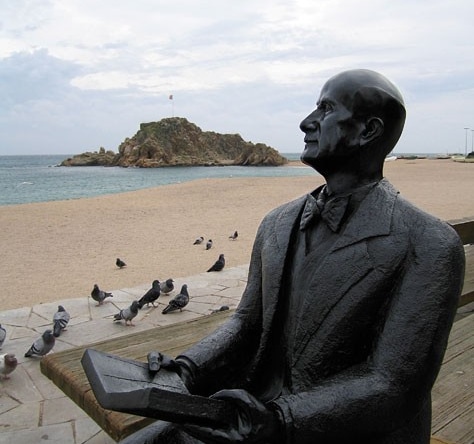

Inheritance and Legaltech

At legal servicesNew technologies have arrived. It is what is called legaltech, and with it its application to inheritances. In Inheritance, founded in 2019 by Ramon Pratdesaba, Lluïsa Morales and Rubén Mendiola, we have one of the success stories of the application of window technology. This type of service allows us to process all the procedures derived from an inheritance in different entities such as the civil registry, the property registry, the notary, financial institutions and insurance companies. All with maximum speed and agility, facilitating tax work and saving taxes to the beneficiaries of the inheritance.