We are going to answer some questions with information about Sareb

Contents

- 1 What is Sareb?

- 2 What does Sarab do?

- 3 What assets did Sareb acquire?

- 4 Does Sareb have private mortgages?

- 5 What price did Sareb pay for bank assets?

- 6 Sareb or Bad Bank

- 7 Is Sareb a bank?

- 8 Do you want to buy a Sareb flat?

- 9 How do I know if a property is owned by Sareb?

- 10 How to contact Sareb's asset managers?

What is Sareb?

It is the acronym for Management Company for Assets from Bank Restructuring, SA It was born in 2012, in the real estate crisis, through the agreement between the Spanish and European authorities to create a company that would be in charge of managing the loans and real estate of the rescued financial entities. Its portfolio is made up of loans to the promoter and real estate.

The Management Company for Assets Proceeding from Bank Restructuring, Sareb, is a public limited company for the management of assets transferred by the four financial entities that were nationalized: Bankia, Cataluny Banc, NCG Banco-Banco Galley and Bando de Valencia, and by the entities in the process of restructuring or resolution as provided for in Law 9/2012: Banco mare Nosrum, CEISS, Caja3 and Liberbank.

Sareb is 55% owned by private capital, and 45% by public capital through the FROB. The FROB is the authority in charge of managing the resolution processes of credit institutions and investment services companies in their executive phase in Spain.

Sareb is considered to be the Bad Bank of Spain. It has a term of 15 years to proceed with the divestment of all its assets. Your goal is to maximize your profitability.

It has legal advantages that do not apply to other corporations, such as preference in the collection of subordinated debt over other creditors under the same conditions.

Sareb works with banking assets, but it is not a bank.

What does Sarab do?

Sareb is a company formed to recapitalize the banks and savings banks most affected by the financial crisis. It is not a bank, and it is dedicated to managing loans and real estate to maximize their value before selling them.

What assets did Sareb acquire?

In 2012 and 2013, it received some 200.000 assets from 9 financial entities, including banks and savings banks. For a value of 50.781 million euros, between financial assets such as credits and loans to the promoter. And another part, 11.343 million, real estate assets, such as homes, land, buildings, offices, commercial premises, etc.

Does Sareb have private mortgages?

It does not have private mortgages. The mortgages that you have in our portfolio are credits from companies and loans to promoters.

Banks and savings banks from which Sareb's assets come from: On December 31, 2012, Sareb added to its portfolio the assets of BFA-Bankia, Catalunya Banc, Banco de Valencia, Novagalicia Banco and Banco Gallego, entities intervened by the FROB (Fund for Orderly Bank Restructuring). In February 2013, the assets of BMN, Liberbank, Caja3 and CEISS were incorporated.

What price did Sareb pay for bank assets?

The value of nearly 200.000 assets we incorporated between 2012 and 2013, was about 107.000 million euros. The price was set by the Bank of Spain at 50.781 million euros, having applied a discount of approximately 50% of its market value.

Sareb or Bad Bank

In other countries they are known by the name of bad bank. Hence the term applied to Sareb, it follows the model of other international organizations that manage what are also called “toxic assets”.

Is Sareb a bank?

It is not a bank, it is an asset management company linked to the real estate sector, it does not have a bank record. What relates it to banking is that in 2012 and 2013 they bought their most compromised collection assets from financial entities that had liquidity problems, as part of a joint strategy of the Spanish State and the European institutions. They must sell those assets.

Do you want to buy a Sareb flat?

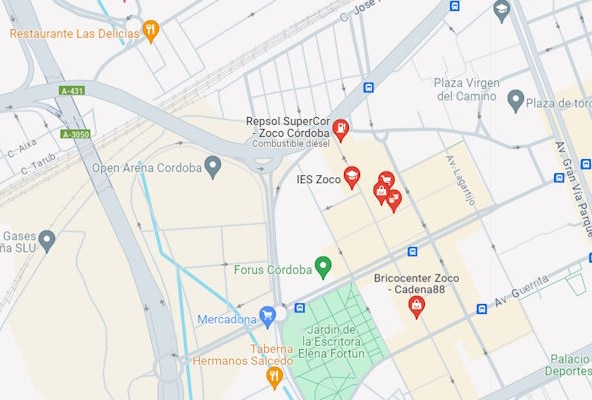

Sareb sells to private customers through intermediaries. The marketers of our properties are Altamira Asset Management, Haya Real Estate, Servihabitat and Solvia. If you are looking for a flat, you can consult the marketers. Regardless of where you buy your home, it is important to have the contracted good home insurance for the protection of you and your family.

How do I know if a property is owned by Sareb?

In the list of properties on their website you can check the properties they have in each municipality. To verify who is the owner of a property, it is necessary to consult it in the Property Registry and request a simple note, which is the document that contains the current information.

How to contact Sareb's asset managers?

You can contact the managers through their websites or on the following telephone numbers:

- Altamira: 914 842 874

- Haya: 901 117 788

- Servihabitat: 942 049 000

- Solvia: 900 690 900

- If you have any questions, you can contact sareb Answer – 900 115 5